Real Estate Finance

Real estate finance can be used by property owners to optimize their balance sheets, as well as by REITs and other real estate businesses to acquire properties efficiently.

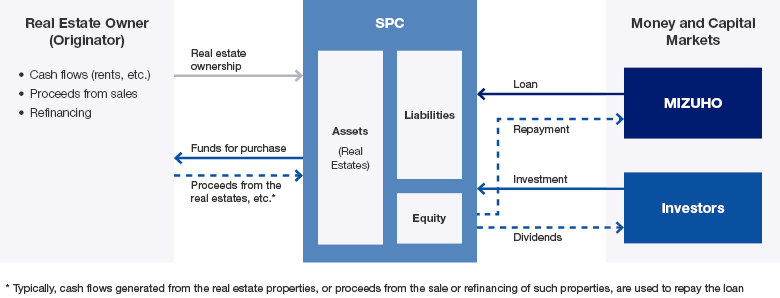

Real estate securitization refers to the process whereby income generated from real estate properties, and the value of the properties themselves, are used as collateral to secure a loan that is then used by a special purpose company (SPC) to purchase the properties.

We design financing proposals to meet the our clients’ specific needs based on the analysis of such factors as the property type, location, purchase price, occupancy rate, and related income versus expenditures.

Typical Structure of a Real Estate Securitization Arrangement

- The real estate owner (customer) agrees to sell their real estate to the SPC.

- The SPC obtains funds for the purchase in the form of a non–recourse loan and investment capital.

- The SPC pays the purchase price to the real estate owner (customer).

-

The SPC uses the cash flows generated from the purchased properties to repay the loan and pay dividends to investors.

Addressing Other Business Needs

The securitization financial model helps real estate owners diversify financing methods and optimize their balance sheet. It could also be used by REITs, etc., to acquire real estate properties.

For those who need to consolidate or relocate their business centers, we provide simulations and cost estimates involved in such an action and suggest plans for effective alternatives. We also advise and provide optimal solutions for any real estate–related issues that may arise in the course of business development.

Notice

- The use of the above products or services is contingent upon the credit assessment in accordance with Mizhuo International Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

- Fees may be charged for using these products or services. The amount and type differ depending on the details of individual transactions.

- Please consult an attorney, accountant, tax accountant, or auditing firm regarding any legal matters, accounting issues, or taxation concerns.