Structured Trade Finance

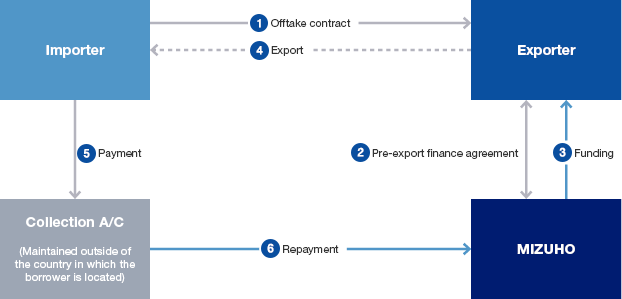

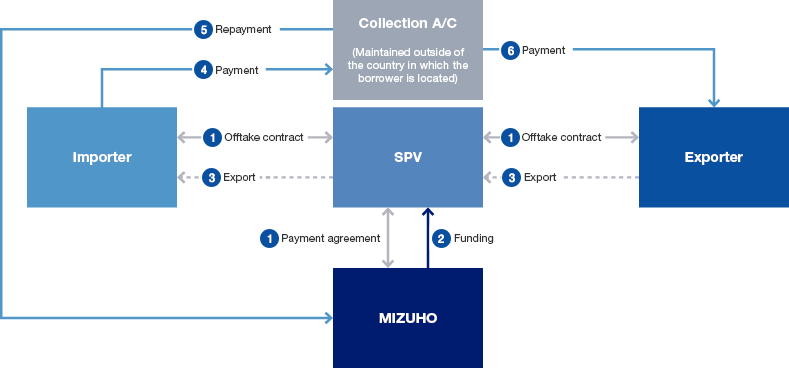

Structured trade finance is a specialized short–term or medium–/long–term (up to 5 years) financing against commodity trade flows. It typically takes the form of pre–payment financing or pre–export

financing, structured around the supply chain and commercial terms of customers, and may use export contracts, trade receivables and collection accounts as collateral.

With dedicated offices in London, New York, Singapore, Hong Kong and Tokyo, we have demonstrated our expertise in providing structured trade finance solutions for our clients around the world.

Structure of a Typical Structured Trade Finance Arrangement

Example of Pre–Export Finance

Example of Pre–Payment Finance

Notice

- The use of the above products or services is contingent upon the credit assessment in accordance with Mizhuo International Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

- Fees may be charged for using these products or services.

- Please consult an attorney, accountant, or tax accountant regarding any legal matters, accounting issues, or taxation concerns.